Trever Christian and John Schwalbach, Partners

January 22, 2024

Share This:

Interest Rate Challenges into Opportunities

Key Observations

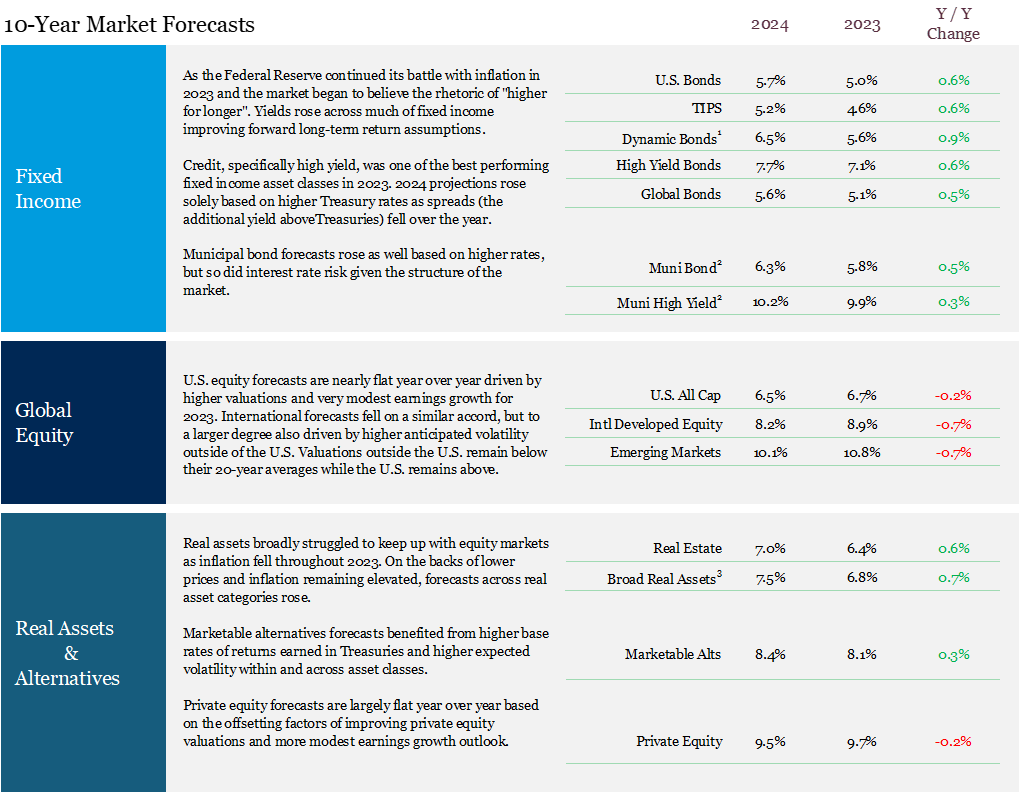

- Our 10-year return forecasts show increased opportunity across fixed income and real assets with a modest step back for equities. This makes for one of the more attractive risk-adjusted returns for fixed income relative to equity we have seen in several years.

- We believe range-bound inflation opens multiple paths to lower rates creating opportunities for tailwinds in fixed income and more rate-sensitive assets.

- The most predicted recession in history continues to shift into the future, however, we also believe investor mindsets should shift from predict to prepare as risks remain acute and market timing futile.

- Narrow market leadership in U.S. equities creates fragility within, and opportunity outside of, U.S. technology stocks. We believe long-term investors will benefit from exposure to U.S. small capitalization and non-U.S. stocks.

Last year we penned our cautiously optimistic outlook, Goodbye Tina, with three primary themes that would influence asset prices in 2023. By and large, our expectations came to fruition. Continued volatility was clearly on display with interest rate volatility not seen since the Global Financial Crisis and while headline equity volatility didn’t set new records, the subtext is important. The stark contrast between -100%1 losses seen in select bank failures and the 200%+[1] gains with some Artificial Intelligence (AI) hype is enough to make heads spin. Moderating inflation was a resounding call as inflation fell from annualized highs of 9.1% in 2022 to 3.2% in October 2023.1 And then comes the Bear Market Bottom. Equities globally, but the U.S. in particular, rallied from October lows in 2022 to July 2023 highs by 28.3%.1 While our outlook themes made the grade, that is not to say the crystal ball was spotless. A banking crisis, U.S. Debt downgrade, military conflict in the Middle East and an AI super cycle were not on our radar. As we look to 2024, we should all acknowledge that humility remains paramount. Our opinions change as the facts change, we build for resilience and seek to stack the odds in our favor. We are excited to share our views of 2024 and beyond.

2024 Themes

A central thread that pulls through our 2024 themes is a favorable shift toward fixed income increased interest though is coupled with moderation. In 2022 we wrote Fixed Income Complacency, a warning for investors who had forgotten the perils of interest rate risks. Over 2022 and 2023, investor views of fixed income shifted from complacency to animosity to indifference. They also reestablished a long-lost relationship with a forgotten asset, cash. Today our 2024 themes, while each distinct and catalyzed by different circumstances, stand in contrast to our earlier writings. What an extraordinary and strange journey fixed income has been on.

The Messy Middle

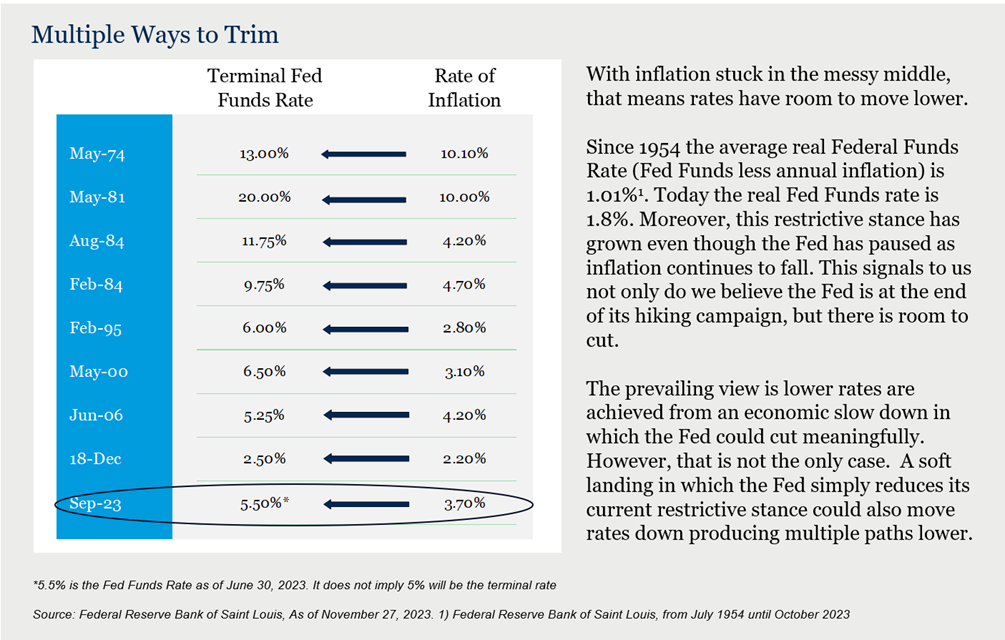

There is a lot of back patting and handshaking that can be done regarding inflation at the Federal Reserve (The Fed). Inflation has fallen from its peak of 9.1% in 2022 to 3.2% in October 2023.1 Some market participants are concerned more work is needed given we remain above the stated 2% average target. Rather, we dismiss 2% as an actual level that must be achieved precisely and believe “normal” inflation is more likely destined to settle higher.

First, 2% is, after all, an arbitrary number. It is far enough away from central bankers’ worst fear, deflation, yet it is below a level of inflation that consumers start noticing (~3%).

Second, it is our view that the Fed is less likely to risk the collateral damage of continued rate hikes, such as adding fragility to the banking system, just for the modest benefit of moving inflation from 3% to 2%. So, if not 2%, what is the target?

We call it the “messy middle”, an inflation range of 2% to 5% and one we believe we will be in for some time. The days of asleep at the wheel 2% inflation where the deflationary tailwinds of globalization are waning. So too are the extraordinary supply-side shocks and consumer revenge spending from COVID.

This range is one that compels vigilance from the Fed that inflation does not rise meaningfully above it, but it is also a range we believe the Fed can use as justification to cease hiking or even begin to cut rates.

Portfolio Impact

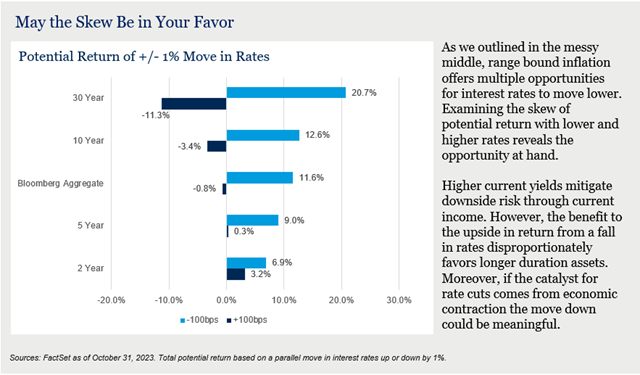

A sustained “messy middle” level of inflation supports both our current portfolio positioning and bolsters our 2024 updates. Our allocation to real assets has the opportunity to succeed and diversify from equity in this environment. However, with range bound inflation we are not compelled to add more at this time. Moreover, with inflation driving the Fed and the Fed controlling the Fed Funds rate, our increased allocation to investment grade U.S. bonds is supported by a Fed policy that shifts to holding rates flat, if not a cutting stance in 2024. For these reasons, our 2024 allocations include increased exposure to investment grade intermediate U.S. fixed income.

Don’t Predict (Recession), Prepare

Economists may mark 2023 as one of the greatest head fakes of all time. Bloomberg’s Here is (Almost) Everything Wall Street Expects in 2023 complied outlooks from 51 institutions, the vast majority of which called for a recession. Quotes like “A recession is all but inevitable” or “2023 will go down as one of the worst for the world economy in four decades”. Yet here we sit with U.S. GDP up 4.7%[1] from Q4 2022 to Q3 2023 (the last reported figure). What went wrong? In short, the tenacity of U.S. consumer spending and far better than excepted results of putting the inflation genie back in the bottle led the U.S. economy and markets higher. Does that mean victory should be declared on recession and that fear shelved? In a word – no. In fact, if anything the odds of an economic slowdown have increased. However, we should also plainly acknowledge that a recession is always coming. It may be right around the corner or years away, but recessions are a regular part of economic growth and contraction. We believe seeking to time their occurrence is futile. A resilient portfolio shifts the objective from predict to prepare and, in our view, one of the most effective ways to do so today is with intermediate investment-grade bonds.

Portfolio Impact

Over the last decade, the expected return of fixed income has been substantially lower than equity. That dynamic has now shifted. Based on our forward-looking estimates, global equity will return just 0.9% more than investment-grade fixed income but do so with 130% more volatility. This makes fixed income attractive relative to equity. Moreover, we believe bonds may add resiliency during periods of economic uncertainty and current higher yields in high quality assets can help investors create more certainty of meeting return targets over time.

As a result, our 2024 allocations not only include increased exposure to investment-grade intermediate U.S. fixed income, but we also expect some portfolios to own more fixed income in aggregate. However, the attractiveness of fixed income should not lead to attempts to time the market. Substantial shifts in allocations in any given year should only accompany substantial shifts in objectives or time horizons. However, the modest shifts that reflect current opportunities to take advantage of market dynamics without losing sight of long-term goals are prudent.

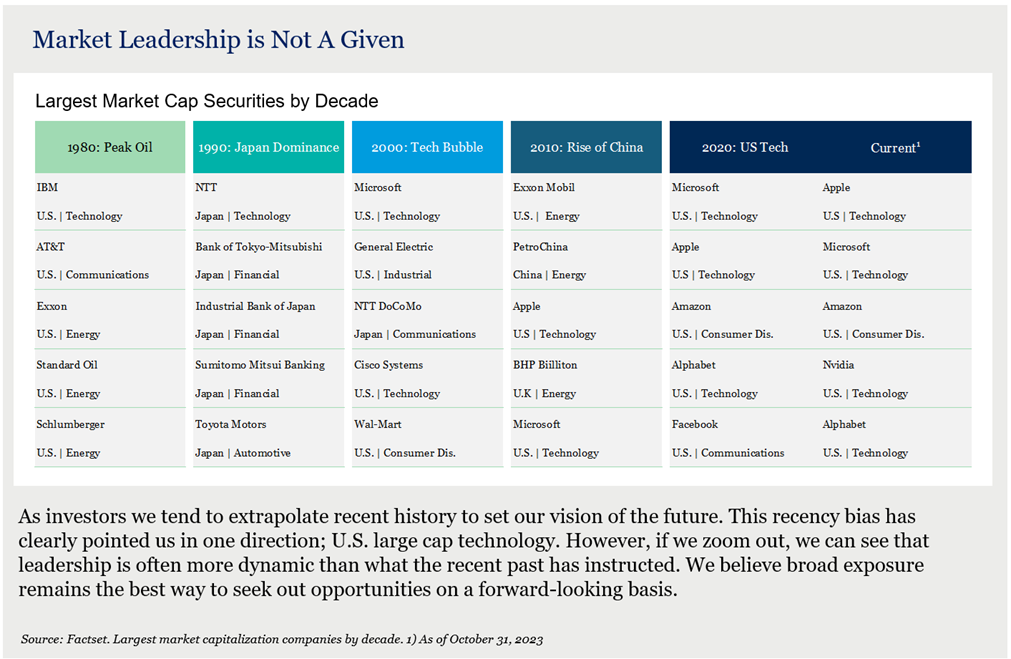

Concentrated Consequences

Then came the “Magnificent 7” – Apple, Alphabet (Google), Meta (Facebook), Microsoft, Nividia, Amazon and Tesla. These seven stocks from the S&P 500 were up on average 94%[1] year to date through November 2023. If we remove these securities from the S&P 500, through the same period the index would be up ~6%3. The seven securities now make up a record setting 28%[2] of the S&P 500 and 48%4 of the growth-oriented Russell 1000 Growth index. A key question is what impact will this narrow group of securities have on future outcomes? It is possible these securities have a repeat performance over the coming years and indices will grow even more unbalanced with a very concentrated group of securities at the top. It is also possible that these securities revert to broader market-level returns and everything else will catch up as markets charge ahead, but concentration dissipates. However, we think a more likely third path over the long-term is that new leadership takes hold making room for sectors, regions or capitalizations that have been left behind over the past decade. Afterall, this is not the first of its kind.

As we demonstrate below, leadership tends to change over time. In 2000 it was the tech bubble, in the 1990s it was Japanese stocks, in the 1980s it was peak oil, in 1972 it was the “Nifty Fifty” and so on. A retort often heard about the Magnificent 7 today is “but these are great companies” and in many cases they are. However, let’s not conflate great businesses and great stocks. Cisco Systems, a gem of the tech bubble, remains one of the world’s most influential technology companies more than 23 years since the tech bubble burst. It also still trades 40%1 below its peak price more than two decades later. Great companies at bad prices can make for bad investments. Additionally, a narrow band of securities contributing to the success of markets intuitively creates more fragility going forward. Much like a sports team, if you lose a star, or multiple star athletes, it is hard to have another step in immediately to take their place.

Portfolio Impact

A narrow band of securities driving markets has two primary impacts in our view. The first is the temptation to extrapolate recent history at the expense of all other underperforming sectors. This concept can be applied to the technology sector vs others, U.S. versus foreign stocks, or even small cap versus large cap stocks.

The second impact is a narrow market creates more fragility and, potentially, risk. With large cap U.S. securities being the majority of most client allocations, it is important to recognize that potential risk and manage it accordingly. To that end, while reducing the magnitude we are maintaining a similar overweight to U.S. small capitalization and non-U.S. securities. We also believe increased allocations (as we outlined above) to fixed income, investment-grade intermediate duration in particular, help offset these potential risks.

Portfolio Allocations

Final Thoughts

The long and variable impact of the momentous move up in interest rates is still being felt and to some degree understood. It has also seemingly taken some of the hubris, though perhaps only temporarily, away from the recession prognosticators. These changes have many important implications for asset prices and the economy. If we step back though, we quickly realize this is a good problem to have. Long-term investors seeking reasonable rates of return no longer must do so by continually extending risk. This was a hallmark of the last decade in which extreme interest rate policies at times produced extreme allocations. As market opportunities “normalize” (if we dare say there is such a thing as a normal market) investors may choose to normalize their allocations with perhaps a more modest risk posture. As we noted, it is important to draw the line between updating portfolios to reflect current opportunities and trying to time the market.

We’d love to hear from you with your feedback, insights or questions so feel free to call 651-797-3532.

[1] FactSet as of November 30, 2023

[2] BLS as of November 29, 2023

[3] Morningstar as of November 30, 2023

[4] Factset as of November 30, 2023, S&P as of November 30, 2023