Trever Christian and John Schwalbach, Partners

July 26, 2022

Share This:

For anyone in need of yet another example of the benefits of routine, consistent saving and investing, this is it.

Retirement plan participants who did so accumulated sizable 401k plan account balances in the last decade, according to a new joint study from ICI and the Employee Benefit Research Institute (EBRI).

Analysis of 401k plan accounts of the 1.3 million “consistent” participants in the EBRI/ICI 401k database from year-end 2010 to year-end 2019 found:

- The average 401k plan account balance for consistent participants rose each year from 2010 through year-end 2019, except for a slight decline in 2018. Overall, the average account balance increased at a compound annual average growth rate of 15.6 percent from 2010 to 2019, rising from $58,658 to $216,690 at year-end 2019.

- The median 401k plan account balance for consistent participants increased at a compound annual average growth rate of 18.8 percent over the period, to $108,433 at year-end 2019.

- The growth in 401k plan account balances for consistent participants generally exceeded the growth rate for all participants in the EBRI/ICI 401k database. By year-end 2019, more than half (53 percent) of the consistent 401k plan participants had account balances of more than $100,000, compared with about one-fifth of 401k plan participants in the entire EBRI/ICI 401k database.

“401k plans remain one of the most important avenues toward a secure retirement, and the account growth for consistent 401k plan participants highlights the power of this important saving and investing tool,” Sarah Holden, ICI Senior Director of Retirement and Investor Research, said in a statement. “While markets can be volatile, the compounding growth and upward trends we observed over the nine-year study period shows the benefit of staying the course in their 401k plans.”

Other Findings

Other key findings include younger 401k participants or those with smaller year-end 2010 balances experienced higher percent growth in account balances compared with older participants or those with larger year-end 2010 balances.

The research also found that these consistent 401k participants tend to concentrate their accounts in equity securities.

Overall, equities—equity funds, the equity portion of target-date funds and other balanced funds, and company stock—represented about two-thirds of their 401k plan account assets at both the beginning and end of the study period.

Freedom Financial Partners’ Article Insight

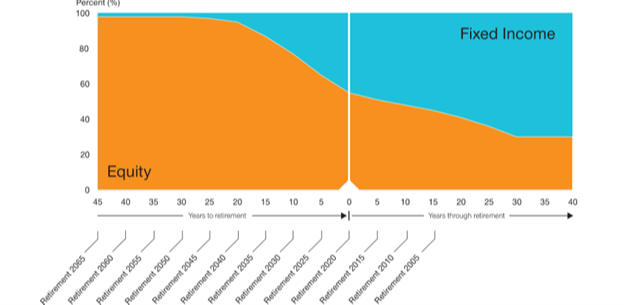

These findings are consistent with what we would expect from equity markets (stocks), which are historically more volatile than fixed income (bond) securities. With volatility, the higher potential reward of account growth is met with the greater possibility of account loss. Therefore, we advise that, over time, individuals rebalance their accounts to become more conservative as they near retirement. Maintaining a higher ratio of equity positions in your portfolio is extremely important for account growth during your years of net worth accumulation, as the findings from this article indicate. However, to protect the accumulated wealth that you’ve saved for retirement, one should begin to shift their portfolio to become more heavily allocated towards fixed income, which is a far less volatile option when compared to equity.

Although this may not apply to every individual’s situation, below is a glidepath that illustrates what this shift in portfolio allocation could look like over time. This is not exact science, but it can give an individual valuable framework when it comes to investing for retirement:

- Accumulation Period (45-20 years Pre-Retirement)

- 90% Equity

- 10% Fixed Income

- Transition Period (20-0 years Pre-Retirement)

- Decrease Equity position by about 10% every 5 years

- Increase Fixed Income position by about 10% every 5 years

- Retire with a 60% Fixed Income to 40% Equity Ratio

This graphic may help you visualize this concept:

If you have any questions about this article, or the insight we have provided, please give us a call: 651-797-3532. Our team is happy to assist with any questions or concerns which you may have.