Trever Christian and John Schwalbach, Partners

December 10, 2024

Share This:

Key Observations

- The end of election season fueled a rally in the U.S. equity markets in anticipation of pro-business policies such as potential deregulation and tax cuts.

- The U.S. dollar appreciated, reflecting expectations of inflationary fiscal policies and potential shifts in Federal Reserve actions.

- The Federal Reserve and Bank of England cut rates by 25 basis points, citing a need to support economic growth amid moderating inflation.

Market Recap

November was a dynamic month across financial markets, shaped by the interplay of easing inflation, political shifts, and evolving investor sentiment. As economic indicators pointed to moderating growth and a cooling labor market, consumer spending remained robust, even as rising household debt hinted at potential cracks in the foundation. Investors are bracing for a gradual economic slowdown into 2025, with the Federal Reserve signaling a cautious, data-driven approach to monetary policy.

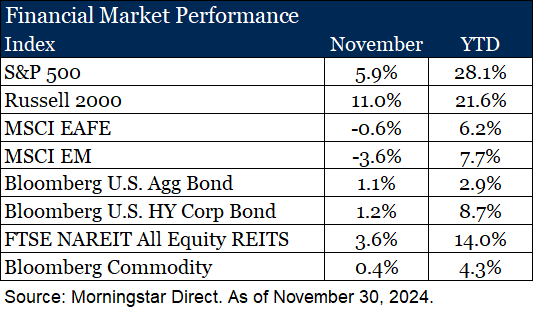

U.S. equity markets led the charge higher during the month, with large cap rising 6% on expectations of deregulation and tax reforms following the recent election. Positive earnings reports and robust consumer spending further bolstered confidence. Small-caps were a standout during the month on lower valuations making them more attractive to investors amid risk-on sentiment. However, international developed and emerging markets underperformed, weighed down by a stronger U.S. dollar and concerns about economic stability in China, particularly in real estate and trade policy.

Central banks continued their easing stance, with the Federal Reserve and the Bank of England cutting rates by 25 basis points each. U.S. bond markets saw modest returns as inflation and fiscal policy uncertainties limited gains. In Europe, political instability and rising inflation created mixed results, while Japan’s bonds declined due to anticipated monetary tightening. Credit spreads tightened further during the month on low supply and resilient corporate fundamentals supported gains in high yield.

The U.S. dollar rose sharply during the month, influencing global trade and asset performance. Commodity markets were mixed as natural gas prices surged due to supply disruptions while precious metals saw profit-taking amid rising geopolitical tensions. Real estate rose during the month as elevated rates continued to dampen home sales and the presidential election introduced hesitation in the market, with both buyers and sellers adopting a “wait-and-see” approach regarding potential policy changes. Other notable real estate sectors were resorts and data centers which benefitted from increased consumer traveling and continuing demand for cloud computing and artificial intelligence.

The Power of Compounding

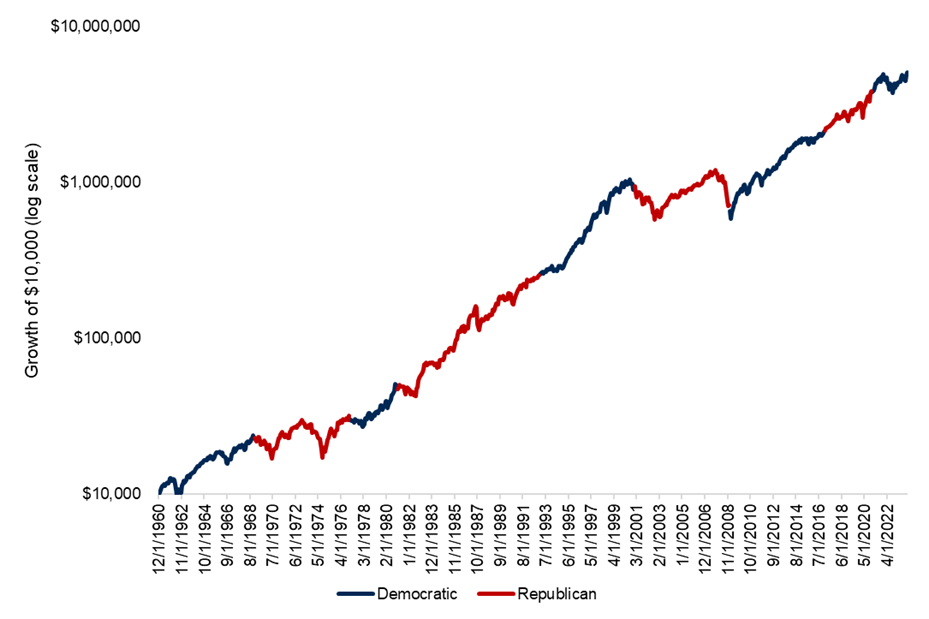

With the U.S. presidential election behind us and U.S. equity markets surging, questions around portfolio strategy often arise. History suggests market timing around elections can erode value. We illustrate this concept in the below chart using cumulative monthly returns of the Ibbotson US Large Stock Index dating back to 1961. The cumulative returns across Democrat and Republican administrations reveal a stark truth: maintaining a long-term, unbiased investment approach yields the most significant growth.

With the U.S. presidential election behind us and U.S. equity markets surging, questions around portfolio strategy often arise. History suggests market timing around elections can erode value. We illustrate this concept in the below chart using cumulative monthly returns of the Ibbotson US Large Stock Index dating back to 1961. The cumulative returns across Democrat and Republican administrations reveal a stark truth: maintaining a long-term, unbiased investment approach yields the most significant growth.

While we would avoid drawing any definitive conclusion from this chart on partisan cycles, the data clearly underscores the importance of staying invested through political cycles. In fact, staying invested through political regimes yielded nearly 10-times higher return than only investing when either democrats or republicans are in office1. We believe portfolio success often depends on resilience and discipline rather than reacting to short-term events. As such, we recommend that investors keep investment decisions independent of political outcomes when building long-term portfolios.

Outlook

As the U.S. transitions power, uncertainty around tariffs, taxes, and regulation will dominate headlines. However, elections often generate more noise than signal for long-term investors. Our focus remains on constructing durable portfolios and partnering with skilled managers to generate alpha in challenging conditions.

We would love to hear from you if you have questions, comments or if we can help in any way: 651.797.3532.

1Schwab Center for Financial Research, Morningstar. Data from January 1, 1961 to December 31, 2023. See disclosures for additional information and definitions.