Trever Christian and John Schwalbach, Partners

August 14, 2024

Share This:

Falling rates and softer inflation contribute to a reversal in market leadership

Key Observations

- Softer inflation data released in July pushed interest rates lower and market expectations for a September Fed rate cut are almost fully priced in. More rate-sensitive assets fared well.

- Market leadership shifted on the back of lower rate expectations and the positive impact it may have on small cap equities, which had their third-best month relative to large cap since 1979.

- The darling AI stocks and other Mag 7 positions took a step back in July. Investor questions surrounding future earnings, capex and the future monetization of AI all took hold and contributed to the selloff in the back half of the month.

Market Recap

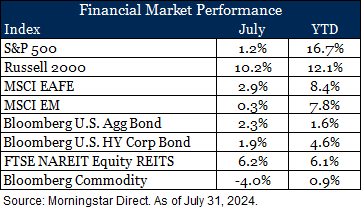

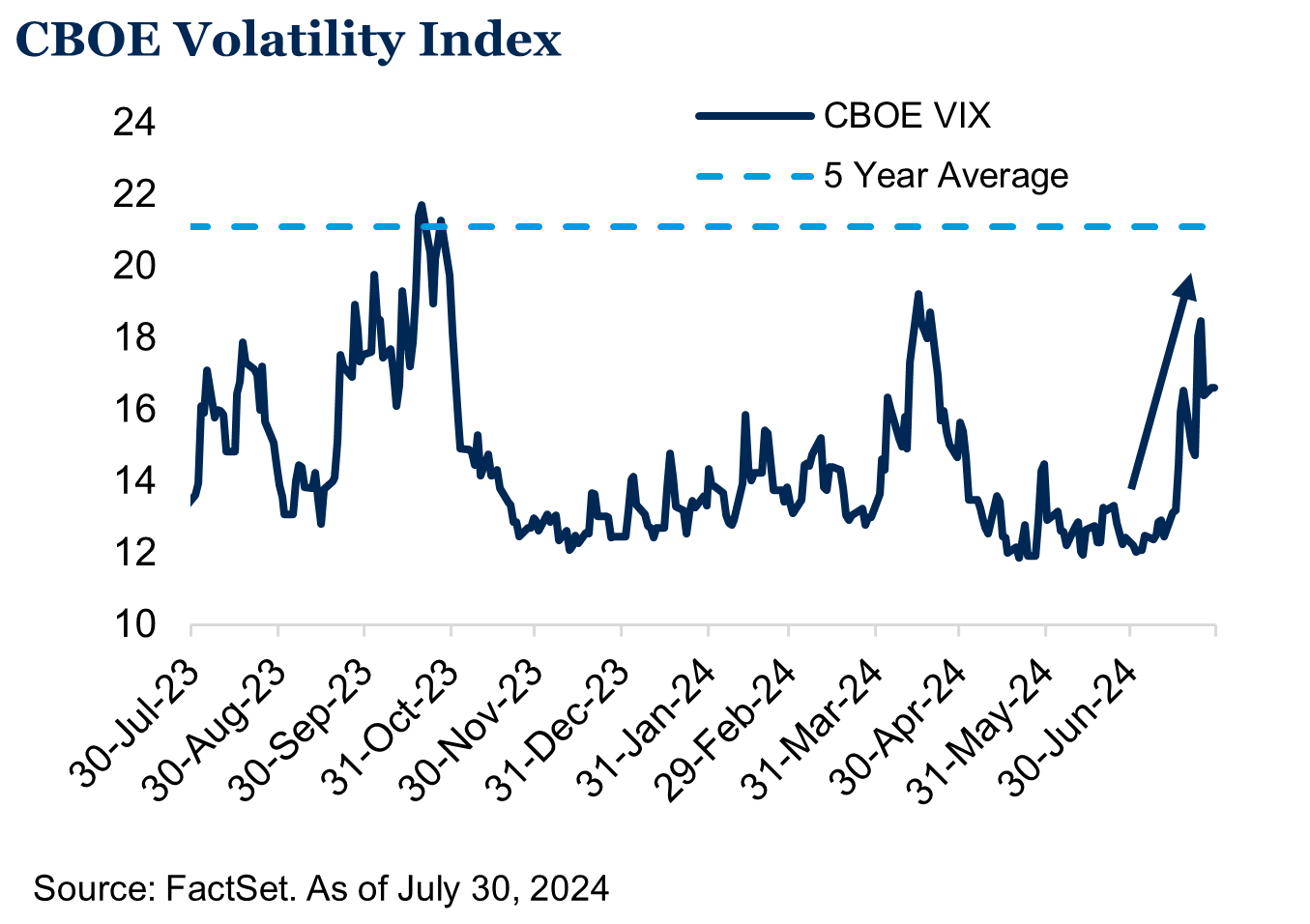

The second half of the year kicked off with no shortage of events. A favorable inflation print, weakening labor market data and political events surrounding the fall election all contributed to the spike in volatility during the month. Expectations of an interest rate cut from the Federal Reserve continue to underpin investor sentiment and we saw a significant shift in market leadership (which we explore below) following the CPI release mid-month. The concentrated large cap leadership from the first half of the year changed course with the S&P 500 Index producing a modest positive return, while U.S. small cap equities (Russell 2000 Index) had a standout month. International equities also moved higher with developed markets (MSCI EAFE Index) producing a modest positive return while emerging markets (MSCI EM Index) were roughly flat for the month. Increased rhetoric and uncertainty about foreign tariffs negatively impacted China, one of the weaker performing regions within emerging markets.

The second half of the year kicked off with no shortage of events. A favorable inflation print, weakening labor market data and political events surrounding the fall election all contributed to the spike in volatility during the month. Expectations of an interest rate cut from the Federal Reserve continue to underpin investor sentiment and we saw a significant shift in market leadership (which we explore below) following the CPI release mid-month. The concentrated large cap leadership from the first half of the year changed course with the S&P 500 Index producing a modest positive return, while U.S. small cap equities (Russell 2000 Index) had a standout month. International equities also moved higher with developed markets (MSCI EAFE Index) producing a modest positive return while emerging markets (MSCI EM Index) were roughly flat for the month. Increased rhetoric and uncertainty about foreign tariffs negatively impacted China, one of the weaker performing regions within emerging markets.

Fixed income markets fared well in the wake of lower interest rates and the Bloomberg U.S. Aggregate Bond Index moved into positive territory for 2024. U.S. CPI fell 0.1% seasonally adjusted in June, the first month-over-month decline since July 2022.[1] The Federal Reserve held the Fed Funds rate steady at 5.25%-5.5% during the July meeting but acknowledged the recent inflation data and a softer labor market in its statement. Other diversifying asset classes had mixed results during the month. Real estate has been nothing short of volatile this year and with the outlook for Fed cuts on the horizon, REITs also moved back into positive territory during July. On the other hand, commodities took a step back and were one of the few areas of the market in negative territory for the month. Supply-demand dynamics negatively impacted oil prices and industrial metals also had a weak month.

Fixed income markets fared well in the wake of lower interest rates and the Bloomberg U.S. Aggregate Bond Index moved into positive territory for 2024. U.S. CPI fell 0.1% seasonally adjusted in June, the first month-over-month decline since July 2022.[1] The Federal Reserve held the Fed Funds rate steady at 5.25%-5.5% during the July meeting but acknowledged the recent inflation data and a softer labor market in its statement. Other diversifying asset classes had mixed results during the month. Real estate has been nothing short of volatile this year and with the outlook for Fed cuts on the horizon, REITs also moved back into positive territory during July. On the other hand, commodities took a step back and were one of the few areas of the market in negative territory for the month. Supply-demand dynamics negatively impacted oil prices and industrial metals also had a weak month.

Market Leadership Shifts in July

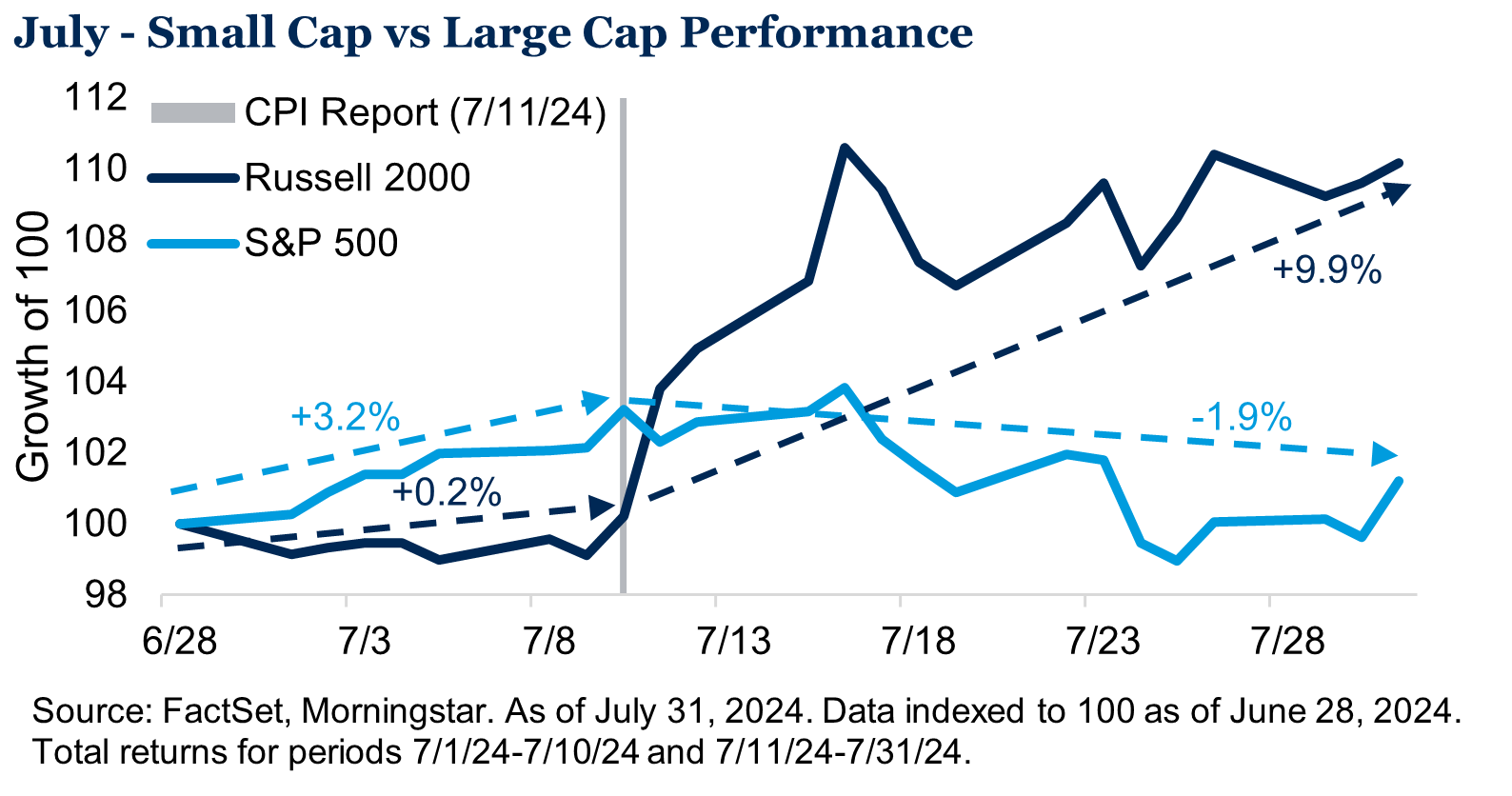

The U.S. inflation report on July 11 marked a turning point for the markets. While levels in headline inflation remain above the Fed’s 2% target, the trend lower over recent months has solidified investor expectations of a rate cut in September.[1] Further supporting investor sentiment was softer labor market data, however we’d be remiss to point out that, despite the recent unemployment rate uptick, the overall labor market has remained resilient thus far. Small cap equities surged in the back half of the month following the inflation print and ended the period 10.2% higher.

The U.S. inflation report on July 11 marked a turning point for the markets. While levels in headline inflation remain above the Fed’s 2% target, the trend lower over recent months has solidified investor expectations of a rate cut in September.[1] Further supporting investor sentiment was softer labor market data, however we’d be remiss to point out that, despite the recent unemployment rate uptick, the overall labor market has remained resilient thus far. Small cap equities surged in the back half of the month following the inflation print and ended the period 10.2% higher.

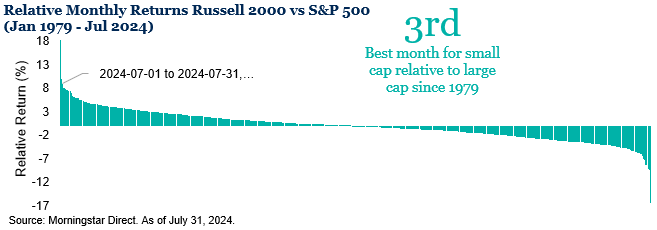

Additionally, investors began to have questions regarding the monetization of AI and the enormous amount of capital expenditures many companies were making in the space, putting pressure on the “Magnificent 7” which fell 0.6% on average in July. While enthusiasm has softened somewhat on the AI craze from earlier in the year, investors will be keying in on the earnings releases in early August for several of these companies. This environment culminated with small cap having its third best month relative to large cap since 1979. Value stocks also shined relative to their growth equity counterparts, benefiting from many of the factors that helped small cap.

Additionally, investors began to have questions regarding the monetization of AI and the enormous amount of capital expenditures many companies were making in the space, putting pressure on the “Magnificent 7” which fell 0.6% on average in July. While enthusiasm has softened somewhat on the AI craze from earlier in the year, investors will be keying in on the earnings releases in early August for several of these companies. This environment culminated with small cap having its third best month relative to large cap since 1979. Value stocks also shined relative to their growth equity counterparts, benefiting from many of the factors that helped small cap.

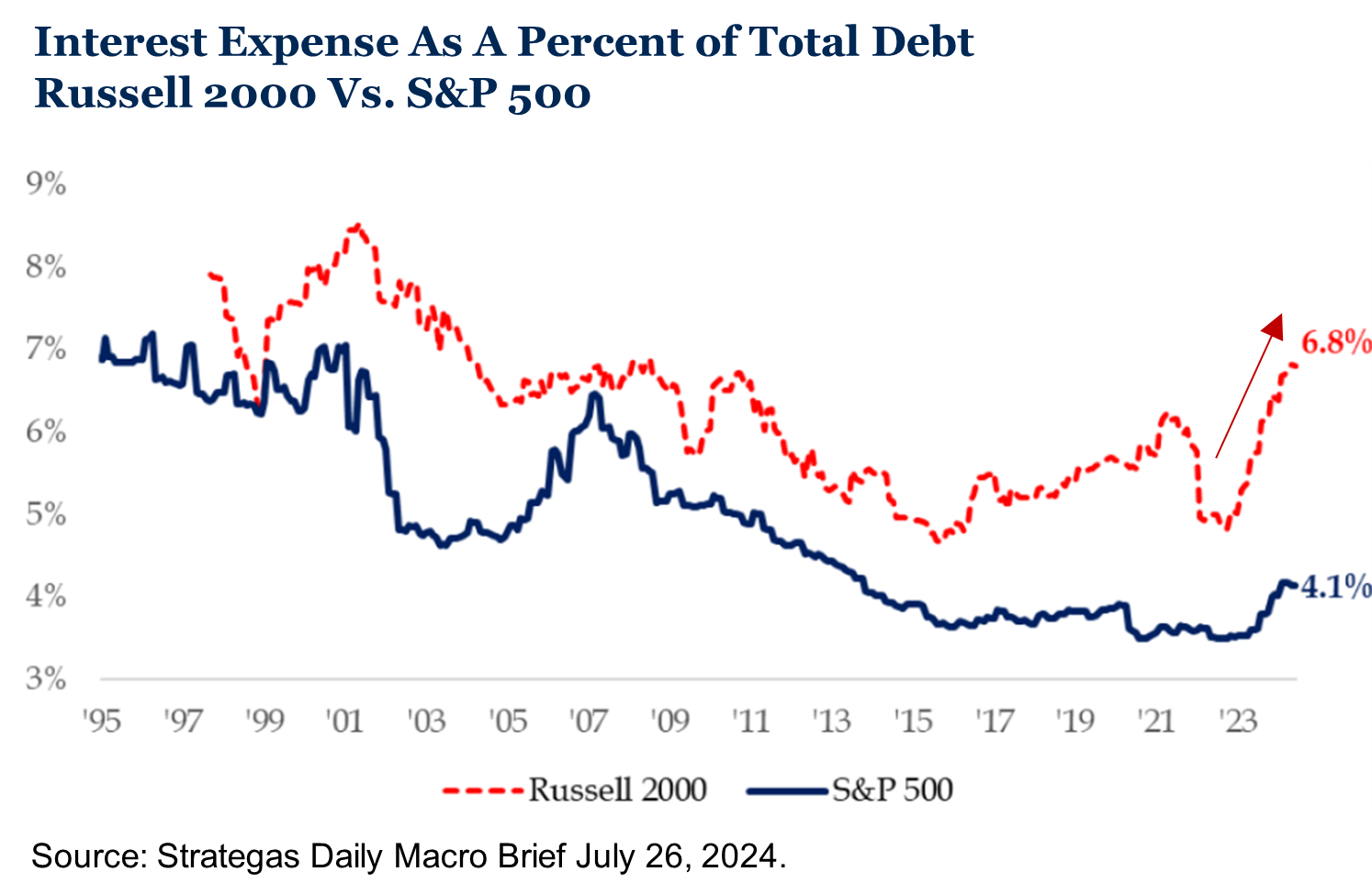

Lower interest rates and expectations for the Federal Reserve to start easing in September were the driving force behind the small cap rally, but let’s take a deeper look at one of the reasons why. Historically interest expense for small cap companies has been greater compared to larger cap companies. Intuitively this makes sense given they are “riskier” and therefore the cost of financing is more expensive. When the Federal Reserve began its tightening cycle in 2022, small caps were disproportionately impacted relative to large caps. Therefore, one could reasonably conclude that small caps may have a greater tailwind if interest rates start to decline.

Lower interest rates and expectations for the Federal Reserve to start easing in September were the driving force behind the small cap rally, but let’s take a deeper look at one of the reasons why. Historically interest expense for small cap companies has been greater compared to larger cap companies. Intuitively this makes sense given they are “riskier” and therefore the cost of financing is more expensive. When the Federal Reserve began its tightening cycle in 2022, small caps were disproportionately impacted relative to large caps. Therefore, one could reasonably conclude that small caps may have a greater tailwind if interest rates start to decline.

Outlook

As we look forward it’s hard to call one month (or half a month for that matter) a trend, but as we highlighted in our Mid-Year Update, we believe the multiple paths lower for the Fed may provide a tailwind for fixed income and the concentration within large cap creates both risks and opportunities. While we do not try to time the market, we recognize the potential opportunities outside of the handful of stocks that have driven much of the market gains over recent months and remain committed to diversified portfolio allocations as we prepare for markets ahead.

We look forward to hearing from you if we can talk, listen or be of service: 651-797-3532.