Trever Christian and John Schwalbach, Partners

August 21, 2023

Share This:

It is no secret that we do not always act in our own rational best interests, we often let our emotions and biases get the best of us when it comes to everyday decisions. Who among us has not resolved at some point in our lives to improve diet or exercise habits and found it incredibly challenging to put thought into action? Why are we apt to skip routine health checkups and vehicle inspections at the risk of major health issues and costly mechanical repairs down the line?

These are just a few examples of the sway psychology holds over our decision-making abilities despite our capacity to think rationally, and it is no surprise that money matters are far from immune. In fact, there is an entire academic discipline dedicated to the investigation of how psychology affects economic decision-making. This field of study has become known as behavioral finance.

Financial Self-Sabotage

“The investor’s chief problem and even his worst enemy is likely to be himself.”

– Benjamin Graham

One well-known psychological phenomenon commonly viewed through the lens of behavioral finance is loss aversion: the tendency for people to put a higher value on avoiding losses over achieving equivalent gains. Loss aversion can sometimes lead to overly conservative investment portfolios relative to individual goals and objectives, and it can often push investors to sell investments at unfavorable times such as market downturns that result in missed opportunities when markets rebound. Other behavioral finance concepts include present bias (our tendency to overvalue the present at the expense of the future), status quo bias (reluctance to initiate a new or change an existing behavior), optimism bias (overestimating the likelihood of positive events and underestimating the likelihood of negative ones), the bandwagon effect (keeping up with the Joneses) and the anchoring effect (our tendency to amplify the most recent data we are exposed to).1

With such a laundry list of psychological factors working against investors, is there any hope of counteracting these negative forces and improving outcomes? Thankfully behavioral finance seeks not just to understand why investors make certain decisions, but it also endeavors to help people overcome their biases and make more sound financial choices.

The Evolution of Behavioral Finance in DC Plans

As critical as workplace retirement plans have become in the retirement equation to everyday Americans it is no surprise that behavioral finance has garnered widespread interest in the defined contribution plan arena. Automatic plan features, Qualified Default Investment Alternatives (QDIA) and the recently passed SECURE 2.0 Act each bear the fingerprint of behavioral finance.

Beginning in 1998 a number of IRS rulings paved the way for plans to automatically enroll eligible employees as long as they were given the chance to opt out, but it wasn’t until the Pension Protection Act of 2006 (PPA) formally endorsed automatic enrollment and automatic escalation that adoption of these features by Plan Sponsors really began to accelerate. These automatic features leverage insights from behavioral finance to counteract participant inertia and short-sightedness — biases that often lead to low participation and savings rates. Automatic enrollment opts employees into retirement plans by default, significantly boosting participation rates, while automatic escalation gradually increases contribution rates over time without requiring participant intervention.

The PPA also introduced QDIAs, which were a huge step forward in overcoming many common behavioral barriers to prudent investing such as the “choice overload” that often leads to decision paralysis when investors are forced to choose their own investment mix. Target date funds — the most prevalent QDIA used by Plan Sponsors — help participants overcome some of the most common investment mistakes by improving diversification across asset classes, avoiding extreme asset allocations, automatically rebalancing periodically to keep participants on course and automatically adjusting to become more conservative as participants near their target retirement age.

More recently, the SECURE 2.0 Act doubled down on behavioral finance principles by further cementing automatic features into law. Section 101 of the legislation requires that all new 401(k) and 403(b) plans with greater than 10 employees (with some exceptions) beginning in 2025 include auto-enrollment and auto-escalation provisions.2 This represents a sea change for the small plan market since smaller plans have been slower to adopt automatic features than larger plans. (A recent survey found a 50-point gap between the percentage of small and large plans that have auto-enrollment.)3 SECURE 2.0 also includes an auto-portability provision that allows Plan Sponsors to move former employees’ retirement assets without their express consent, a feature widely expected to reduce plan “leakage” (i.e., early withdrawals).2

Lastly, the retirement industry has been intentional about integrating the findings of behavioral finance into employee education, wellness and advice offerings. For example, many providers have successfully implemented voluntary auto-escalation as part of the opt-in enrollment process whereby a participant can make an affirmative election at enrollment to “save more tomorrow.”4 One analysis found that plans with automatic enrollment and voluntary annual increases had a higher median deferral rate than those with voluntary enrollment only (7% vs. 6%).5 Another paper authored by behavioral finance expert Shlomo Benartzi found that something as simple as the number of blank lines on a retirement plan website can impact a participant’s level of diversification, and tweaking the design of the enrollment website can increase overall plan contributions by 10%.6

Behavioral Finance Successes

It’s one thing for legislation and the retirement industry to embrace the principles of behavioral finance, but are Plan Sponsors subscribing to it as well, and is it ultimately improving employee retirement readiness? Thankfully there are several industry surveys we can reference to answer these questions.

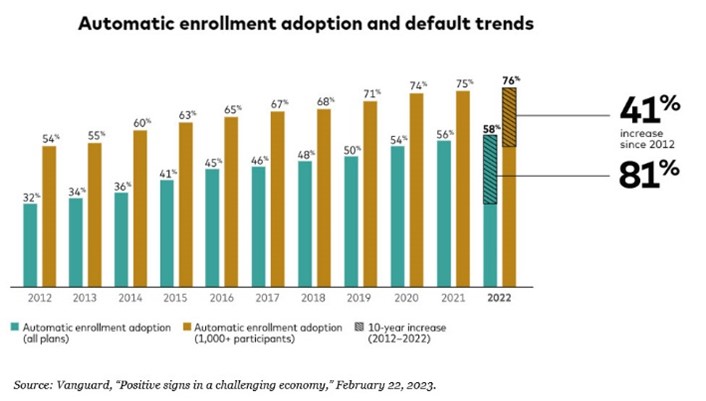

Perhaps one of the most encouraging observations from recent data is the trendline of Plan Sponsors adopting automatic enrollment. As illustrated below, in the 10 years ending 2022 there has been an 81% increase in automatic enrollment adoption amongst all plans on the Vanguard recordkeeping platform.7

Another reputable industry survey reported in its current edition that over the last decade the number of plans with an auto-escalation feature has increased 35%3:

Higher adoption of these auto-features by Plan Sponsors is delivering real results for retirement savers, with both participation and deferral rates recently hitting record highs as seen in the figure below.

The difference in savings rates between plans that have adopted automatic enrollment and those that have not is stark: a recent analysis demonstrated that among new hires, participation rates triple to 91% under automatic enrollment compared with 28% under voluntary enrollment.8

In terms of investment defaults, nearly all plans use a QDIA (84%), and for 87% of those plans the QDIA is a target date fund. This represents a 28% increase over the last decade of the inclusion of target date funds in plans, while the average plan asset allocation to these vehicles has more than doubled over the same time period.3

It’s worth noting that despite the economic challenges from the COVID-19 pandemic that persisted through 2022, participant savings and investing behavior last year remained fairly steady. 89% of participants either increased or made no change to their deferral rates, while just 11% decreased or stopped their deferrals altogether.9 Excluding participants that use managed accounts, only 6% of participants initiated an exchange in 2022 compared with 8% in the prior year, a noteworthy finding given the economic uncertainty and volatility faced by participants last year.9 Underlying participant investment allocations arguably also made strides in a challenging environment: 66% of Vanguard participants were invested in a professionally managed allocation through last year, up two percentage points from 2021.9

Behavioral Finance Opportunities

“There’s no shortage of remarkable ideas, what’s missing is the will to execute them.”

– Seth Godin

While the retirement industry and Plan Sponsors have made significant progress in leveraging behavioral finance to improve retirement outcomes, how can we build upon the existing foundation? The low-hanging fruit would seem to be the significant number of plans that have yet to adopt automatic plan features. Even in the market segment where automatic features have flourished — plans with 1,000 or more participants — nearly a quarter of plans have yet to implement automatic enrollment.10 A similar case can be made for automatic escalation. This represents a significant number of organizations and retirement savers missing out on the power of the “nudge” in their workplace retirement plans.

Those plans that have taken the positive step to adopt automatic enrollment should also consider their default deferral rate. Two-thirds of all plans have an initial default deferral rate less than 6%,3 yet research suggests that employee opt-out rates hardly vary between plans that choose a 2% or 6% rate.8 The industry widely recognizes participants need to target a total savings rate of 12-15% (including employer contributions) so anything that helps get savers to that target range quicker should be embraced.

Lastly, providers continue to innovate when it comes to applying behavioral finance principles to their employee education, wellness and advice offerings. A recent example worth noting is research conducted through Voya that suggests plans with voluntary automatic deferral escalation could benefit from default enrollment options with faster (e.g., 90 days vs. 365 days) and higher (e.g., 2% vs. 1%) escalators.10

Don’t let status quo bias or decision paralysis get the best of your retirement plan. Leverage your plan consultant to help evaluate various plan designs, features and services through the lens of behavioral finance to find the solutions best suited to make a meaningful impact for your organization.

We would be happy to hear from you with questions regarding this or any other way we can be of assistance (651.797.3532).