Trever Christian and John Schwalbach, Partners

May 10, 2023

Share This:

Key Observations

- Muted returns of broad market indexes for the month of April hide the churn underneath as the lagged and variable impact from higher rates take hold.

- Leading Economic Indicators (LEI) show more ardent anticipation of economic contraction. History would suggest four months or more of declining indicators is a warning of a recession. As of March 2023, the LEI index has fallen for 12 consecutive months.

- Volatility in the banking sector may reduce access to capital which may hinder economic growth.

- Our outlook for 2023 surmised the transition away from zero-bound interest rates was likely to be a bumpy one, and our views for 2023 remain unchanged with allocations designed to help weather the potential for volatility.

Market Recap

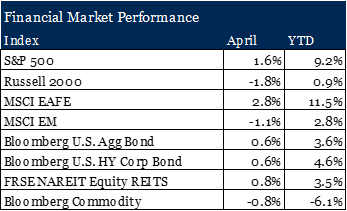

The sanguine April return of headline indexes hides the churn underneath. Equity and fixed income indexes alike posted modestly positive returns overall with year-to-date trends for 2023 continuing in April; longer duration outperformed shorter duration, credit outperformed Treasuries, international developed equity outperformed the U.S. and emerging and commodities took another step back.

Source: Morningstar Direct. As of April 28, 2023

However, the long lag and variable impact of higher interest rates are starting to take root. A tour through April headlines including First Republic’s demise and Leading Economic Indicators (LEI) slowing gave renewed confidence to the bears while bulls gravitated to the resiliency of the labor market and early upside surprises in first quarter earnings.

Don’t Bury the Lead

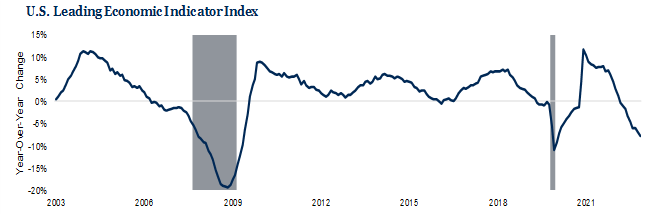

Lagged indicators, such as Gross Domestic Product (GDP) or employment help measure the past but have little predictive value for the future. Leading Economic Indicators (LEI) by contrast seek to proceed economic change by looking further up the value chain. For example, a potential leading indicator of future home inventory is building permits. Unlike the strength of lagged indicators today, leading indicators have been falling.

Sources: FactSet, Conference Board, ECRI. As of March 31, 2023. Grey bars indicate recession period.

Historically, four months of falling leading indicators are enough to raise the eyebrows of economists for a potential economic slowdown. In fact, since 1993 the longest consecutive fall for the LEI index without a recession occurring was three months1.

Leading up to the Global Financial Crisis, the LEI index fell 10 of the 12 months prior to the start of the recession in December 2007, eight months consecutively1. Prior to the recession in February 2001, the LEI index fell eight of the preceding 12 months, five months consecutively1. As of March 2023, the LEI index has fallen 12 of the last 12 months1. Where there is no economic law stating that a falling LEI index produces a recession, we believe it would be unwise to interpret the recent equity markets rally as an all-clear signal. Adding to this complexity is the recent volatility we have seen in the banking sector.

The Banking Effect

An important part of the economic engine is lending. People and businesses often borrow money so they can purchase items. For example, individuals often do not pay all cash for a house or a car, they finance it. Businesses often do not pay all cash for inventory or equipment, they finance it. Rising interest rates have made loans more expensive, however, the additional added effect of stress in the banking sector has also made loans less available.

Source: St. Louis Fed Board of Governs Survey Data January 2023

The effect of tighter standards in banking is less lending, which is a potential headwind for economic growth. The recent news of First Republic being sold to JPMorgan underscores the potential for continued tightening of lending standards putting additional pressure on the economy.

Outlook

Our 2023 outlook surmised the transition away from a zero-bound interest rate economy and market was likely to be a bumpy one. To that end our continued volatility theme helped underpin our thoughts around risk management and building resilient portfolios meant to weather a variety of economic scenarios. So, while the risk of economic contraction as we outlined above may be rising, this is not an unanticipated event. Additionally, our theme of moderating inflation appears on track with recent data showing signs of material improvement. These views reinforce our opinion that the Federal Reserve is nearing the end of its rate-hiking cycle and our proactive updates at the beginning of 2023 put us in a strong position for the markets ahead.

Please reach out if there’s anything you’d like to talk with us about: 651-797-3532.