Trever Christian and John Schwalbach, Partners

April 27, 2023

Share This:

“By failing to prepare, you are preparing to fail.” – Benjamin Franklin

Yes, you’ve probably heard this quote before, and no, we don’t think that you don’t understand the importance of preparation. However, context is key.

For example, consider someone who’s studying for an exam. As long as it’s not a pop-quiz, they will be able to prepare for a set of questions which cover a certain topic. Nevertheless, if they knew exactly which questions would be asked of them, the required time to prepare would be far less onerous. The exam became much easier when knowing the questions in advance.

So how does this pertain to exit planning? We realize that business owners understand the importance of maximizing their business’ value; however, they may not recognize which problems need to be solved. Having access to the context is the differentiator between preparation and planning. As financial planners for business owners, it’s the context we can provide.

Planning for the Future, Today

This year, we are tremendously fortunate to say that Freedom Financial Partners has been a successful entrepreneurial practice for 10 years. We’ve learned what it means to be business owners and how a business fits into a long-term financial plan. Oftentimes, the business becomes our largest asset and can determine how our financial lives play out to a substantial degree. Despite this, very few business owners have a comprehensive financial plan that fully incorporates their business. Consequently, if your largest asset is not accounted for, you may end up trying to put together a puzzle while missing most of the pieces. The context we help provide is where the business fits into their long-term financial plan.

The Value of Creating a Business Exit Plan

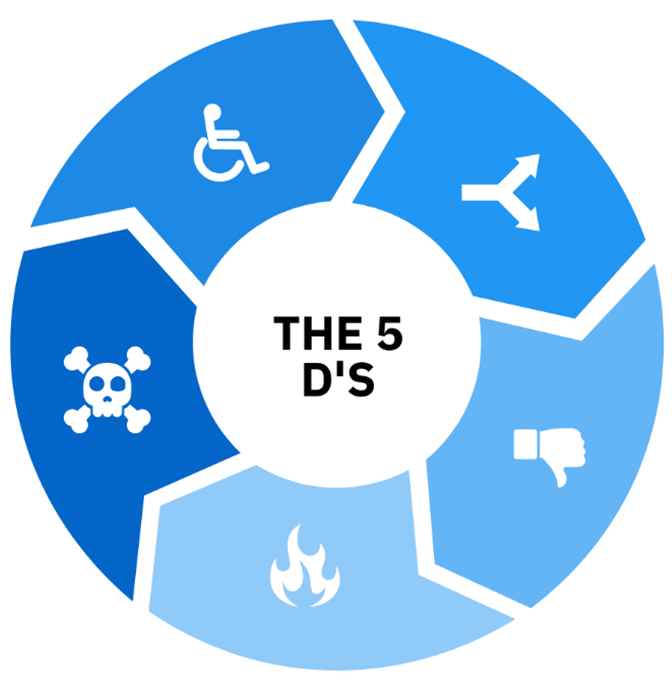

Just as it’s important to have life insurance in the event of a death, having a business exit plan will help provide financial resiliency. We’ve found that many of the business owners we work with are not thinking about this critical type of protection until it’s too late. For you and your business, this could mean waiting until one of the following events happen:

Death

If you died unexpectedly, do you have a plan for those who would be impacted? Are the beneficiaries listed on your insurance policies and assets accurate?

Disability

If you became physically or mentally impaired, would your business be able to operate in a comparable capacity? Do you have a power of attorney for financial and medical matters?

Divorce

If your spouse filed for divorce, how would the share of your business be valued? How would your altered financial arrangements affect the operation of your business?

Disagreement

When multiple members are a part of an ownership team, there’s a good chance that not everyone will agree upon the same things. Given the likelihood of disagreement, how will your business interest be valued and paid? How should a buy/sell agreement be structured?

Distress

As many of us learned in 2020, unpredictable events can have an immediate impact on the productivity and health of our businesses. In the event of such business-altering disruptions, what insurance or contingency plans do you have set in place? Would your business be able to survive a pandemic?

Any of these events could have a disastrous effect on the health of your business, which is ultimately the health of your complete financial plan. Don’t be like many people and wait for one of these events to happen to you. By that time, it is often too late to address them in a manner which maximizes business value. In fact, when set-backs are unprepared for, they usually result in a sharp loss of value.

When building the value of your business, a good defense can often be the best offense.

Steps to Take Today

Knowing that there are many circumstances which can affect the value of your business, we must first begin by addressing the most critical question: what is your business worth?

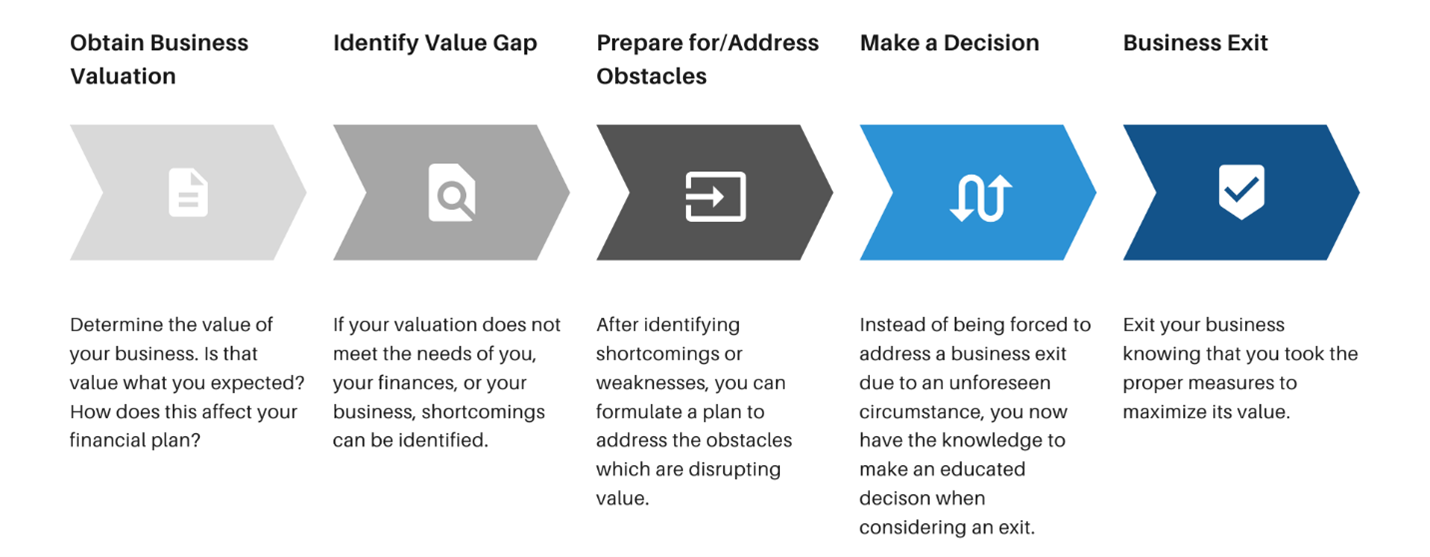

Understanding the value of your business will provide the ability to determine if current personal, financial, and business needs are being met. If they aren’t, a gap may emerge between the value of your business and the amount you would need to maintain your lifestyle after an exit. Understanding the value gap in your business is the difference between having a true plan versus having an idea. An idea is an expectation for how events will play out, whereas a plan accounts for the obstacles which you may encounter.

After taking this critical step, the remaining process could look like this:

As you can see, addressing the gap between your valuation and your needs in advance helps to prepare you for a business exit. By having sufficient time to address problems that negatively affect the value of your business, you will be better positioned to create an opportunity for strategic growth. As with any investing opportunity, access to more time provides greater potential for building an asset’s value. This is the framework for creating a business exit which helps maximize your wealth and ensures that you exit at the right time. Don’t be caught off guard by an event which could disrupt you and your business’ trajectory. It’s much easier to avoid damage than it is to recover from it.

Closing Remarks

Successfully building, maintaining, and exiting a business involves having a plan for the unexpected. Just as we build our investment accounts and establish protective measures to support a comfortable retirement, we must account for our largest asset, our business. While the life of your business and your personal life may feel separated, understand that they are one and the same when it comes to your financial well-being. A well-established financial plan should support both at the same time.

For more insights like this, please take the opportunity to join our monthly newsletter where we cover everything there is to know about building and protecting your wealth. You can sign up at ffpforme.com (on the BLOG page). As always, we hope that you’re living richly!