Welcome to guidance-driven investing.

Ultimately, your money is a resource to help you live life richly.

Your investment portfolio should be tailored to your unique goals and how you define what “living life richly” means to you. Collaborating with Freedom Financial Partners helps ensure that your financial journey supports your vision of living your rich life.

We listen to your goals and priorities, tailoring our approach to your life and vision.

Gain the ability to make well-informed decisions with clarity and confidence.

We build a personalized financial roadmap that empowers your investment strategy.

How do we build a portfolio?

Our investment process and tools enable us to build a customized portfolio that aligns with your preferences and objectives. Here’s a glimpse into our approach:

Understand

Together, we unlock insights into the significant influence your personal investing preferences can have on shaping your investment portfolio.

Evaluate

We conduct a comprehensive analysis to compare your preferences and ensure they are aligned with your desired risk profile.

Build

Through the expertise of our experienced portfolio managers, we develop portfolios that are tailored to your unique priorities and goals.

Monitor

We regularly assess and modify your investments to reflect changes in your life circumstances and evolving priorities.

Understand Your Investment Preferences

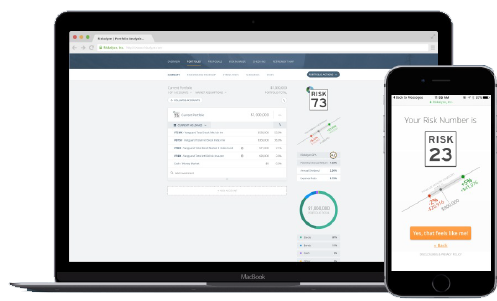

Our state-of-the-art tools help us both understand your investment preferences and how they will impact your portfolio.

-

Participate in an open dialogue about investments with your advisor.

-

Understand the benefits and trade-offs of your investment decisions.

-

While honoring your preferences, your advisor will create your customized portfolio based on your risk tolerance.

Evaluate: Compare Your Portfolio Preferences to Your Portfolio

We believe there’s no such thing as a one-size-fits-all portfolio. The financial plan you build with your advisor, and your output from the InvestmentViewfinder exercise, helps to determine the investment attributes most important to you and the benefits and trade-offs to each.

Performance

OBJECTIVE:

Seeks higher relative returns in the long run (a full market cycle).

TRADE-OFFS:

- Less tax conscious

- Less protection against severe market declines

- Potential for higher cost

- Potential for higher risk & volatility

Low-Cost Tracking

OBJECTIVE:

Seeks to closely match its benchmark at a low cost.

TRADE-OFFS:

- Won’t outperform benchmark due to expenses

- Less protection against severe market declines

- Less tax-conscious

Protection

OBJECTIVE:

Seeks to mitigate against severe bear market declines.

TRADE-OFFS:

- Tax-conscious considerations are secondary

- Forgo relative outperformance versus the benchmark

- Potential for higher cost

Tax Advantaged

OBJECTIVE:

Seeks to lower taxes in the long run (a full market cycle).

TRADE-OFFS:

- Likely no pre-tax outperformance

- Less protection against severe market declines

- Potential for higher cost

Build: Create Your Customized Portfolio

Your advisor will build your customized portfolio with a core strategy and specialized solutions based on your goals and your suitability for certain investments. The core strategy provides exposure to stocks and bonds, while specialized investments will complement your portfolio with active equity strategies, personalized tax-managed strategies, or values-based strategies.

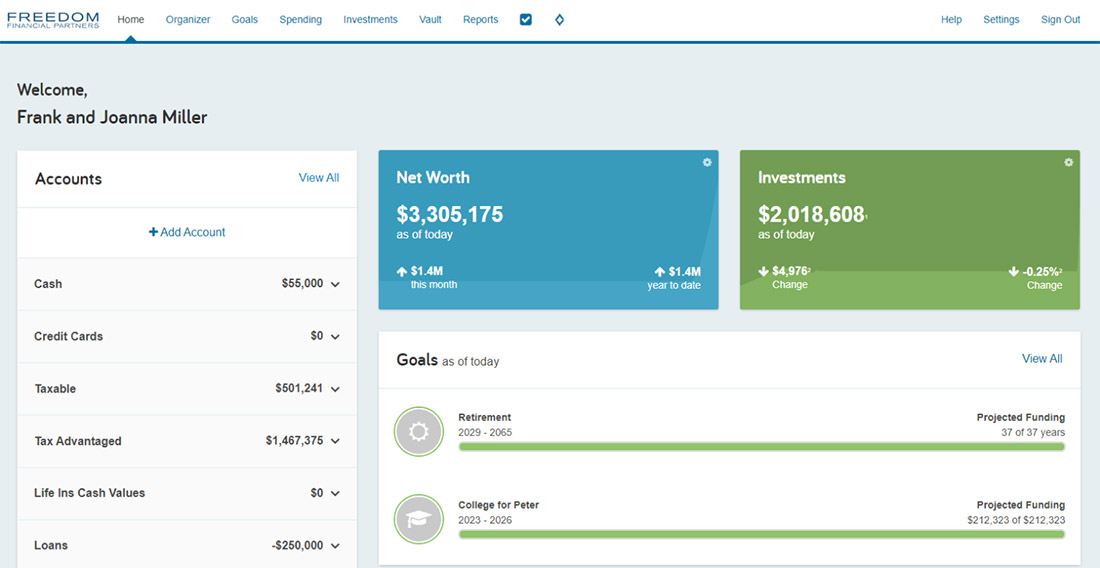

eMoney Keeps You Up to Date

Keep tabs on your investments with eMoney, our dynamic, easy-to-use online financial life management portal that helps you engage with your advisor to oversee your finances anywhere, anytime. It allows you to take on life’s changes with clarity and control—no matter how complex life can become.

“We’ve loved the care and advice you have shown us and look forward to many years together!”

Testimonials presented by individuals may not be representative of the sentiments of other clients of Freedom Financial Partners, and we encourage you to independently evaluate our firm based on additional criteria that you deem appropriate.